Budgeting using percentages is a practical and intuitive way to manage finances, offering a flexible framework that adapts to different income levels and financial goals. Rather than focusing on fixed dollar amounts, this method allocates portions of income to various categories based on proportional values. It’s a strategy that simplifies decision-making and provides clarity, especially for individuals or businesses dealing with variable income. By thinking in terms of percentages, you create a scalable system that maintains balance regardless of fluctuations in earnings.

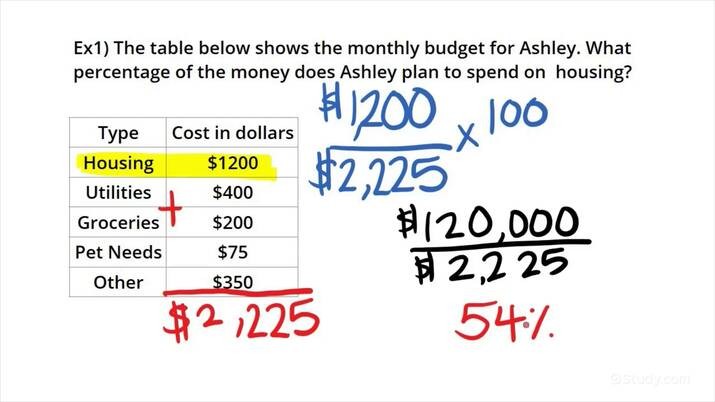

The foundation of percentage-based budgeting begins with identifying core spending categories. These typically include essentials like housing, food, transportation, savings, and discretionary expenses. Assigning a percentage to each category helps ensure that no single area consumes more than its fair share of income. For example, allocating 50 percent to necessities, 20 percent to savings, and 30 percent to lifestyle spending creates a structure that promotes financial health while allowing room for personal enjoyment. This approach is particularly useful for those who want to avoid overcommitting to fixed costs and maintain flexibility in their spending habits.

One of the strengths of budgeting with percentages is its adaptability. As income changes—whether due to a raise, a new job, or a temporary reduction—the budget adjusts automatically. This is especially valuable for freelancers, entrepreneurs, or anyone with irregular earnings. Instead of recalculating every line item, you simply apply the same percentages to the new income level. For instance, if a freelancer earns $5,000 one month and $3,000 the next, the allocations shift proportionally, preserving the integrity of the budget without requiring a complete overhaul. This dynamic quality makes percentage-based budgeting both resilient and efficient.

Businesses also benefit from this method, particularly when managing operational costs and planning for growth. By allocating percentages to categories like payroll, marketing, research and development, and reserves, companies can maintain financial discipline while remaining agile. This approach supports strategic decision-making, as leaders can quickly assess whether spending aligns with priorities. For example, if marketing expenses consistently exceed their allocated percentage, it may prompt a review of campaign effectiveness or a reallocation of resources. Percentage-based budgeting provides a clear lens through which to evaluate performance and make informed adjustments.

The psychological aspect of budgeting with percentages shouldn’t be overlooked. It encourages mindfulness and intentionality in spending. When you know that only a certain percentage of your income is designated for discretionary purchases, you’re more likely to pause and consider whether a purchase aligns with your goals. This built-in constraint fosters discipline without feeling restrictive. It also helps prevent lifestyle inflation, where increased income leads to proportionally higher spending rather than increased savings or investment. By keeping percentages consistent, you ensure that financial progress accompanies income growth.

Implementing this method effectively requires a clear understanding of your financial picture. Tracking income and expenses over time helps establish realistic percentages that reflect actual needs and priorities. It’s important to revisit these allocations periodically, especially as circumstances change. A new mortgage, a growing family, or a shift in career focus may warrant adjustments. The goal is not to lock yourself into rigid rules but to create a framework that evolves with you. Regular reviews ensure that your budget remains relevant and aligned with your values.

Technology can enhance the experience of budgeting with percentages. Many financial apps and tools allow users to set percentage-based goals and monitor progress in real time. These platforms often provide visual dashboards that make it easy to see how spending compares to targets, offering insights that support better decision-making. For businesses, accounting software can automate the tracking of percentage allocations, streamlining reporting and analysis. Leveraging these tools reduces the administrative burden and increases the likelihood of sticking to the budget.

Education and communication are also key, especially in shared financial environments. Couples, families, or business partners should discuss and agree on percentage allocations to ensure alignment. This transparency fosters trust and collaboration, making it easier to navigate financial decisions together. It also helps prevent misunderstandings or conflicts that can arise when expectations differ. By establishing a shared framework, everyone involved can contribute to financial stability and success.

Ultimately, budgeting using percentages is about creating a balanced and sustainable approach to managing money. It offers structure without rigidity, clarity without complexity, and discipline without deprivation. Whether you’re an individual striving for financial independence or a business aiming for profitability, this method provides a scalable and adaptable foundation. It transforms budgeting from a chore into a strategic tool, empowering you to make choices that support both short-term needs and long-term aspirations. With consistency and reflection, percentage-based budgeting becomes not just a technique, but a mindset—one that fosters confidence, control, and financial well-being.