Insurance has always been about managing risk, but in today’s world the very nature of risk has changed. The age of uncertainty is defined by rapid technological shifts, global economic volatility, climate change, and geopolitical instability. These forces create challenges that are harder to predict and more complex to mitigate. For businesses and individuals alike, insurance is no longer just a safety net for traditional risks such as accidents or property damage; it has become a strategic tool for navigating an environment where the unexpected is increasingly the norm.

One of the defining features of uncertainty today is its interconnectedness. A disruption in one part of the world can quickly ripple across industries and geographies. A cyberattack on a major financial institution, for instance, can affect supply chains, consumer confidence, and even regulatory landscapes. Insurance in this context must evolve beyond isolated coverage to address systemic risks. Companies are now looking for policies that not only protect their assets but also provide resilience against cascading effects that can arise from global shocks.

Technology has added another layer of complexity. Digital transformation has created new opportunities, but it has also introduced vulnerabilities that traditional insurance models were not designed to handle. Cybersecurity threats, data breaches, and the misuse of artificial intelligence are risks that require specialized coverage. Insurers are adapting by offering policies that account for digital exposures, but the challenge lies in quantifying risks that are constantly evolving. Insuring against technological uncertainty means creating flexible frameworks that can adjust as new threats emerge.

Climate change is perhaps the most visible driver of uncertainty. Extreme weather events are occurring with greater frequency and intensity, disrupting communities and economies. Traditional property and casualty insurance is being stretched to its limits as insurers grapple with rising claims and unpredictable patterns. In response, new models are being developed that incorporate climate science, predictive analytics, and resilience planning. Insurance in this space is no longer just about paying out after a disaster; it is about incentivizing adaptation and helping businesses and individuals prepare for a changing environment.

Economic volatility also plays a significant role in shaping uncertainty. Inflation, currency fluctuations, and shifting trade policies can all impact the stability of markets. For businesses, this means that insurance must extend beyond physical assets to cover financial exposures. Political risk insurance, trade credit insurance, and supply chain coverage are becoming more important as companies seek to protect themselves from disruptions that originate outside their immediate control. Insuring against economic uncertainty requires a broader view of risk that encompasses both tangible and intangible assets.

The human dimension of uncertainty cannot be overlooked. Pandemics, demographic shifts, and changing workforce dynamics have highlighted the need for insurance that addresses health, well-being, and labor risks. The COVID-19 pandemic demonstrated how quickly global systems can be disrupted, and how critical insurance is in providing stability during crises. Health insurance, business interruption coverage, and employee protection policies have all taken on new significance. Insuring against human-centered uncertainty means recognizing that resilience is not just about infrastructure but also about people.

For insurers themselves, the age of uncertainty presents both challenges and opportunities. Traditional actuarial models, which rely on historical data to predict future outcomes, are less effective when the future is shaped by unprecedented events. Insurers must embrace new tools such as machine learning, scenario modeling, and real-time data analysis to remain relevant. At the same time, uncertainty creates demand for innovative products and services. Insurers that can adapt quickly and provide solutions tailored to emerging risks will find themselves in a position of strength.

Businesses, too, must rethink how they approach insurance. It is no longer sufficient to view coverage as a compliance requirement or a cost of doing business. Insurance must be integrated into broader risk management strategies, aligned with corporate resilience planning, and treated as a lever for long-term sustainability. Companies that proactively engage with insurers to design customized policies are better equipped to navigate uncertainty. This collaborative approach ensures that insurance is not just reactive but also anticipatory.

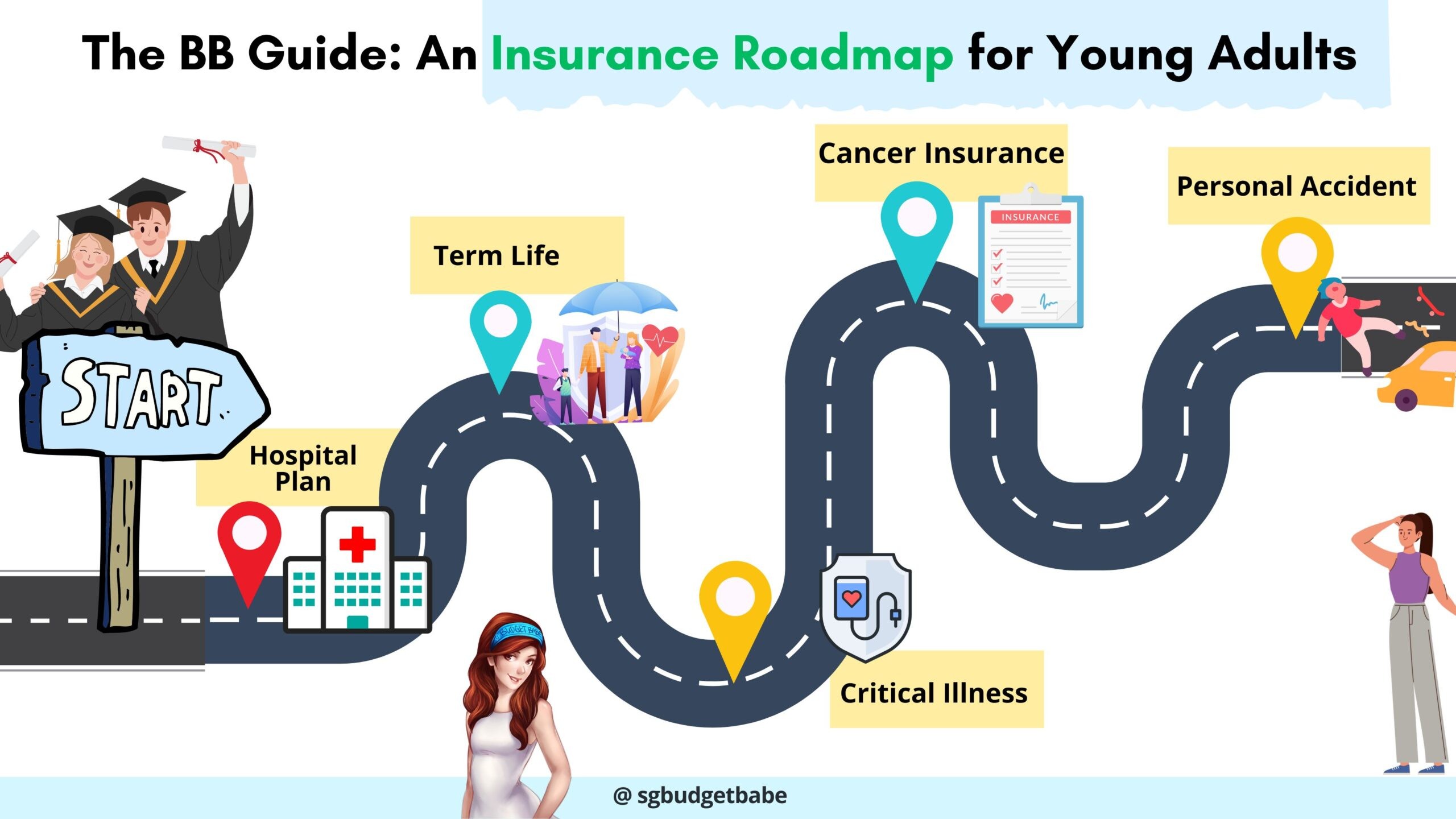

Individuals face similar challenges in insuring their lives and livelihoods. The traditional model of insuring against predictable risks such as illness, accidents, or property damage is being supplemented by coverage for more complex uncertainties. Identity theft, digital privacy, and even reputational damage are areas where individuals increasingly seek protection. Insuring against personal uncertainty requires awareness of how modern life intersects with technology, society, and global events, and how those intersections create new vulnerabilities.

The psychological aspect of insurance in uncertain times is also worth noting. Knowing that coverage exists provides peace of mind, allowing businesses and individuals to focus on growth and innovation rather than constant worry. Insurance acts as a stabilizing force, enabling risk-taking in environments where unpredictability might otherwise paralyze decision-making. This assurance is intangible but powerful, reinforcing the role of insurance as not just a financial product but a cornerstone of confidence in uncertain times.

Ultimately, insurance in the age of uncertainty is about resilience. It is about recognizing that risks are no longer isolated or predictable, and that managing them requires a holistic, adaptive approach. Insurers, businesses, and individuals must all embrace the reality that uncertainty is here to stay. By treating insurance as a dynamic tool rather than a static product, society can better prepare for the challenges ahead. The goal is not to eliminate uncertainty but to ensure that when it arrives, we are ready to withstand its impact and continue moving forward.

As the world becomes more complex, the importance of insurance will only grow. It will serve as both a shield against immediate risks and a framework for long-term resilience. In this way, insurance becomes more than a financial mechanism; it becomes a strategic partner in navigating the unknown. The age of uncertainty demands nothing less than a reimagining of how we protect ourselves, our businesses, and our communities. Insurance, when designed with foresight and adaptability, is one of the most powerful tools we have to thrive in a world defined by unpredictability.