Financial agility during a recession isn’t about panic or drastic measures—it’s about adaptability, foresight, and the ability to pivot with purpose. When economic conditions tighten, the individuals and businesses that fare best are those who can respond quickly without compromising their long-term goals. Agility means being prepared to shift gears, reallocate resources, and make decisions based on current realities rather than past assumptions. It’s not about having all the answers—it’s about having the flexibility to ask the right questions and act decisively.

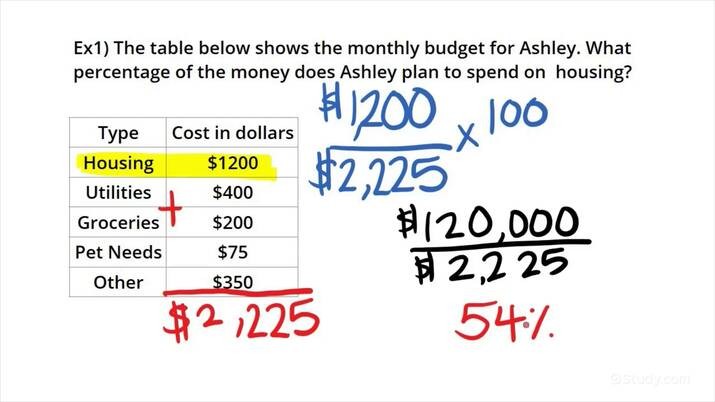

The first step toward financial agility is understanding your baseline. In times of uncertainty, clarity becomes a strategic asset. Knowing your income sources, fixed expenses, variable costs, and financial obligations allows you to assess your position with precision. For example, if your income is at risk due to industry volatility, identifying which expenses are essential and which are discretionary helps you make informed adjustments. This kind of financial self-awareness isn’t just useful—it’s empowering. It gives you the confidence to respond rather than react, and to make changes that are thoughtful rather than impulsive.

Cash flow management becomes critical during a recession. When revenue slows or becomes unpredictable, maintaining liquidity is key. That means prioritizing cash reserves, delaying non-essential purchases, and ensuring that you have access to funds if needed. For instance, a small business might choose to renegotiate payment terms with vendors or reduce inventory to preserve cash. An individual might pause large purchases or shift spending toward necessities. These decisions aren’t about scarcity—they’re about strategy. Preserving cash gives you options, and options are the currency of agility.

Diversification also plays a vital role. Relying on a single income stream or revenue source can be risky when the economy contracts. Exploring alternative ways to earn or generate value can provide a buffer against disruption. For example, a freelancer might expand into adjacent services, or a company might explore new markets or digital channels. On a personal level, someone with a full-time job might consider part-time consulting or monetizing a skill. Diversification isn’t about abandoning your core—it’s about reinforcing it with complementary opportunities that increase resilience.

Agility also requires a shift in mindset. During a recession, fear and uncertainty can cloud judgment and lead to paralysis. Financially agile individuals and organizations cultivate a mindset of curiosity and problem-solving. They ask what’s possible, not just what’s wrong. For example, instead of focusing solely on cost-cutting, they explore ways to add value, improve efficiency, or strengthen relationships. This proactive approach turns challenges into catalysts for innovation. It’s not about ignoring the risks—it’s about engaging with them constructively.

Communication becomes more important than ever. Whether you’re managing a household budget or leading a team, transparency and collaboration are essential. Sharing your financial strategy, discussing priorities, and inviting input fosters trust and alignment. For instance, a family might sit down to review expenses and agree on temporary adjustments, while a business might hold regular check-ins to assess performance and explore new ideas. Open communication reduces anxiety and builds a shared sense of purpose. It turns financial planning into a collective effort rather than a solitary burden.

Technology can support agility by providing real-time data and automation. Budgeting apps, financial dashboards, and forecasting tools help you monitor trends, identify risks, and make timely decisions. For example, tracking your spending weekly rather than monthly allows you to spot issues early and adjust quickly. Automating savings or bill payments ensures consistency even when your attention is elsewhere. Technology doesn’t replace strategy—it enhances it by making information more accessible and actions more efficient.

Flexibility in planning is another hallmark of financial agility. Rigid budgets and fixed goals can become liabilities when circumstances change. Building in contingencies, setting tiered priorities, and allowing for adjustments helps you stay responsive. For example, instead of committing to a single savings target, you might create a range based on income variability. Or you might identify which expenses can be scaled up or down depending on your financial position. This kind of dynamic planning keeps you engaged and prepared, even when the path ahead is uncertain.

Resilience is built not just through preparation, but through reflection. Taking time to review what’s working, what’s not, and what you’ve learned reinforces your ability to adapt. For instance, if a cost-cutting measure improves efficiency without sacrificing quality, that insight can inform future decisions. If a new income stream proves viable, it might become a permanent part of your strategy. Reflection turns experience into wisdom, and wisdom is the foundation of agility.

Ultimately, being financially agile during a recession is about staying grounded while remaining flexible. It’s about knowing your numbers, understanding your priorities, and being willing to evolve. It’s not a one-time adjustment—it’s an ongoing practice of awareness, action, and adaptation. When you approach financial challenges with clarity and creativity, you don’t just survive—you position yourself to thrive. And in times of economic uncertainty, that kind of agility is not just valuable—it’s essential.